Deciding what Investment Approach to Take

Define your investment plan

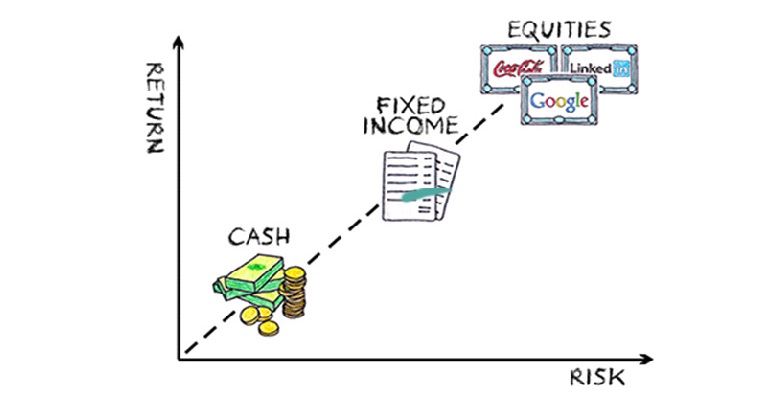

Before investing money you first want to identify your personal and financial goals. Is your priority to maximize the growth of your assets or do you want to preserve your capital? When will you need to access your money? Maybe you’re saving for retirement that is many years away or retirement is in your near future. Are you using the investment money for something other than retirement, such as college savings or a large purchase? By defining you’re end goal, you will have a better idea of the investment strategy that will help you reach that outcome.Evaluate your risk tolerance

Understanding what kind of investor you are and what your risk tolerance is will be helpful when deciding your investment strategy. It’s important to pick the risk level that would best fit your beliefs and personality. Our recommendation to our clients is that your investments shouldn’t keep you from sleeping at night. If they do, you’re not invested properly.

Other tips for investing

By working with a financial planner you will have access to many more tips and guidance for investing your money. At the very least, it’s good to get a second opinion on how you’re investing. Here are a few extra tips when considering investing: • Never invest money that you might need in the short-term. Having an emergency fund will allow you to not have to worry about using your investments during time of need. • Only make investments that you understand. Good research leads to good investment decisions. If you don’t understand how and why a company makes money, don’t make the investment. • Keep your emotions out of your investments. Excitement when the market is up or fear when the market is down can wreak havoc on your investment decisions. This could lead you to buy high and sell low or miss out on rapid recoveries that begin during uncertain times.For more information on investment strategies that would be best for you, set up an appointment with Sgroi Financial. You can also listen to my interview with Clay Moden on 106.5FM WYRK.

WEEKLY SEGMENT ON WYRK

You can catch our weekly Plan.Protect.Invest. segment live on WYRK 106.5FM at 7:20am every Wednesday. Each week we will have a Sgroi Financial planner on with Clay Moden and the WYRK morning show to discuss financial topics to educate and help their listeners. Since 1971, Sgroi Financial has proudly served Buffalo, NY and the Western New York community from our West Seneca location.Address

Phone

Check out the background of our investment professionals on: BrokerCheck

Securities offered through Cadaret, Grant & Co., Inc., member FINRA/SIPC. Advisory services offered through Sgroi Wealth Advisory Group LLC, an SEC Registered Investment Advisor. Sgroi Wealth Advisory Group LLC, Sgroi Financial LLC, and Cadaret, Grant & Co., Inc. are separate entities.

Due to various state regulations and registration requirements concerning the dissemination of information regarding investment products and services, we are currently required to limit access of the following pages to individuals residing in states where we are currently registered.

We are registered to sell Securities in the following states: AZ, CA, CO, CT, FL, GA, IL, KY, MA, MD, MI, MO, NC, NJ, NV, NY, OH, PA, RI, SC, TN, TX, UT, VA, and WA

Client Login