Understanding Your Risk Tolerance

Identifying your risk tolerance

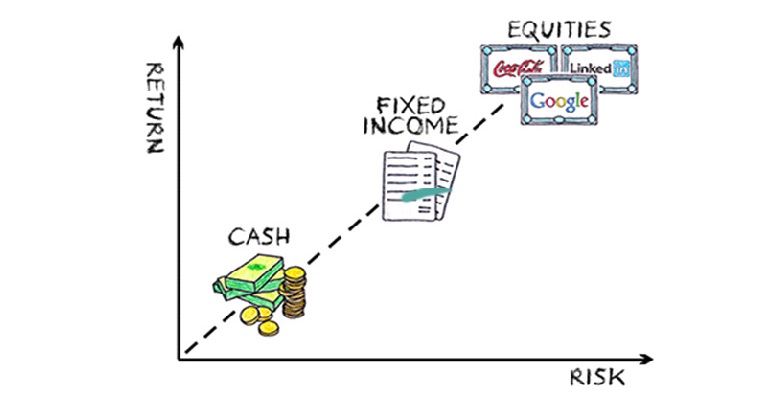

Everyone has their own risk tolerance that is unique to them. The financial industry tends to lump individuals together on a preserved risk tolerance based on their age alone. If you’re this age, you should be this aggressive. Instead, I personally believe that the amount of risk you sustain should be based on your needs. The goal is to accomplish your financial goals with taking the least amount of risk. If you’re losing sleep over your investments, then you have not correctly identified your risk tolerance.What’s your roller-coaster

The perfect analogy when deciding risk levels is to think of a roller-coaster. Are you comfortable with the small roller-coaster that provides some smooth ups and downs? Or are you looking for a thrill seeking, edge of your seat with large swings and turns type of ride? Maybe you’d be most comfortable with something in between both of those spectrums. When building your personal investment portfolio, it is important to take in all the factors that come with equities and fixed income. In addition, know how long your time horizon is and stick to your plan. Because like with roller-coasters the only person who gets hurt is the one that gets off in the middle of the ride.

WEEKLY SEGMENT ON WYRK

You can catch our weekly Plan.Protect.Invest. segment live on WYRK 106.5FM at 7:20am every Wednesday. Each week we will have a Sgroi Financial planner on with Clay Moden and the WYRK morning show to discuss financial topics to educate and help their listeners. Since 1971, Sgroi Financial has proudly served Buffalo, NY and the Western New York community from our West Seneca location.Address

Phone

Check out the background of our investment professionals on: BrokerCheck

Securities offered through Cadaret, Grant & Co., Inc., member FINRA/SIPC. Advisory services offered through Sgroi Wealth Advisory Group LLC, an SEC Registered Investment Advisor. Sgroi Wealth Advisory Group LLC, Sgroi Financial LLC, and Cadaret, Grant & Co., Inc. are separate entities.

Due to various state regulations and registration requirements concerning the dissemination of information regarding investment products and services, we are currently required to limit access of the following pages to individuals residing in states where we are currently registered.

We are registered to sell Securities in the following states: AZ, CA, CO, CT, FL, GA, IL, KY, MA, MD, MI, MO, NC, NJ, NV, NY, OH, PA, RI, SC, TN, TX, UT, VA, and WA

Client Login