As you strive to reach your financial goals or prepare for retirement, you may decide to look to a financial advisor for assistance. When searching for the right fit, there is always the looming question of “how much does a financial planner cost?” Fee rates and compensation structures will differ for each financial professional when you have that initial first meeting, which can make it challenging to know how much you will be paying or wondering if you’re getting a fair deal with the advisor. It is important to know and understand the differences between the fee structures, and how much the fees will cost before deciding which financial planner has your best interest in reaching your future financial goals.

Understanding Financial Advisor Fee Structures

When it comes to payment for financial planning advice, there are a few different ways an advisor charges a fee for their services. The fee structure may be defined by the planner’s preference or what services they offer. Four main types of fees that you will most often see are:

1.

Percentage of assets under management

A planner charges a certain percentage of the client’s total assets that they oversee; the fee amount may vary based on the amount of assets under management. At Sgroi Financial, this is typically the way that we manage our clients’ assets. With this type of arrangement, we are in this together. We believe this way is beneficial to because we have an incentive to grow the funds.

2.

Hourly charges

This fee structure is a set hourly rate that does not change based on the client’s asset level. This is mainly for special projects or consulting.

3.

Fixed fees

A set fee would be in place for a certain type of service. You would know what is included ahead of time, but you would not receive ongoing management. For example, a planner creates a financial plan based on your goals, and you would carry out this plan yourself.

4.

Commission-based fees

The advisor would be paid through commissions on what they sell you and receive compensation when a trade or purchase is made.

Financial advisors may charge one or a combination of these fees.

Fee-only advisors only earn money from fees paid by their clients. They do not earn commissions from selling products or trading securities in their clients’ portfolios.

Fee-based advisors, however, earn money both from the fees their clients pay as well as commissions and other forms of third-party compensation.

The Cost of Financial Advisor Fees

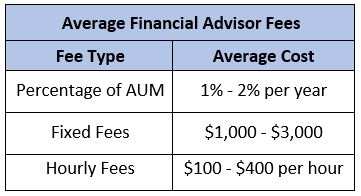

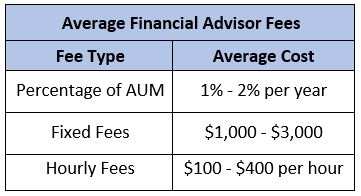

When it comes to the cost of a financial planner, most firms charge fees based on a percentage of assets under management (AUM) for ongoing portfolio management. Based on a 2018 RIA in a Box study, the average financial advisor cost is 0.95% of AUM for a $1 million account. Based on this study, the average fees are:

It is an important decision who to trust in helping you plan your financial future, and which payment structure best fits your needs. Each advisor might not offer all the available fee structures; however, they should be willing to be fully transparent in discussing their fees. At Sgroi Financial, we openly discuss performance and fees as we are focused on your best interests. We offer online access to all Sgroi Financial accounts, annual reviews, and unlimited access to your planner and service staff to ensure your satisfaction. If you are ready to start your financial plan or sit down to go over your current assets, call our office today to set up an appointment!

It is an important decision who to trust in helping you plan your financial future, and which payment structure best fits your needs. Each advisor might not offer all the available fee structures; however, they should be willing to be fully transparent in discussing their fees. At Sgroi Financial, we openly discuss performance and fees as we are focused on your best interests. We offer online access to all Sgroi Financial accounts, annual reviews, and unlimited access to your planner and service staff to ensure your satisfaction. If you are ready to start your financial plan or sit down to go over your current assets, call our office today to set up an appointment!

It is an important decision who to trust in helping you plan your financial future, and which payment structure best fits your needs. Each advisor might not offer all the available fee structures; however, they should be willing to be fully transparent in discussing their fees. At Sgroi Financial, we openly discuss performance and fees as we are focused on your best interests. We offer online access to all Sgroi Financial accounts, annual reviews, and unlimited access to your planner and service staff to ensure your satisfaction. If you are ready to start your financial plan or sit down to go over your current assets, call our office today to set up an appointment!

Client Login