How to Avoid Emotional Investing

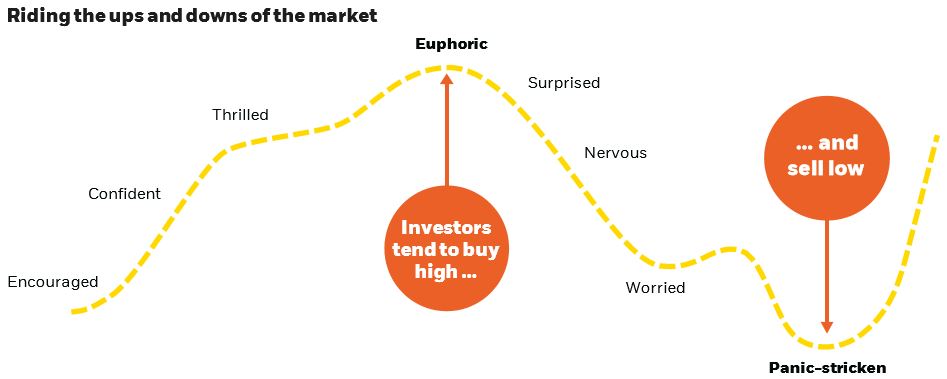

Figure 1 – Chart from BlackRock demonstrates the euphoric versus panic-stricken fear of buying high and selling low when investing.

Emotional Investing & Bad Timing

Often times, emotional investing is an exercise affiliated with bad market timing. Listening and following the news media and other social platforms can be a helpful way to detect when bull or bear markets are developing because the daily buzz of the stock market can create a potential investing opportunity for investors. However, media reports can also include rumors, outdated advice, and other nonsensical amounts of information which aren’t beneficial for decision-making in the stock market. Ultimately, individual investors are accountable for their trade decisions, and must be cautious when looking for the right time to invest based on the latest news headlines. Rational and realistic thinking help us to understand when an investment may be an intriguing investment opportunity and avoid the poor ones.Strategies to Avoid Emotional Investing

Two popular approaches to investing, dollar-cost averaging and diversification, can take some indecisiveness out of investment decisions and reduce risk of poor timing due to emotional investing. Dollar-cost averaging is a strategy where equal amount of dollars are invested at a regular, predetermined interval. This approach can be implemented in any market condition. The key to this approach is to stay the course. Set the strategy and don’t change it unless a major change permits revisiting your investments and rebalancing your established plan. This method can work best in 401(k) plans with matching benefits, as a fixed dollar amount is deducted from each paycheck and the employer provides additional contribution amounts. Diversification is a process of buying an array of investments rather than just one or two; it helps diminish the emotional response to market volatility. During normal market cycles, using a diversification strategy provides an aspect of protection because losses in some investments are balanced out with gains by others. Diversifying a portfolio can take many forms such as investing in different businesses and/or industries, geographical regions, types of investments, and even branching out in real estate investments and private equity. It’s easier said than done to invest without involving emotions. Understanding your own risk tolerance and the risks in your investments can be an important and useful factor when making rational decisions with your financials.ABOUT SGROI FINANCIAL

Sgroi Financial is a full service, independent financial planning firm proudly serving the Western New York area since 1971. We offer services that will help you achieve your financial goals including retirement planning, investment management, estate planning, college planning and insurance. We help individuals, families, retirees, working adults, young adults and business owners.Check out the background of our investment professionals on: BrokerCheck

Securities offered through Cadaret, Grant & Co., Inc., member FINRA/SIPC. Advisory services offered through Sgroi Wealth Advisory Group LLC, an SEC Registered Investment Advisor. Sgroi Wealth Advisory Group LLC, Sgroi Financial LLC, and Cadaret, Grant & Co., Inc. are separate entities.

Due to various state regulations and registration requirements concerning the dissemination of information regarding investment products and services, we are currently required to limit access of the following pages to individuals residing in states where we are currently registered.

We are registered to sell Securities in the following states: AZ, CA, CO, CT, FL, GA, IL, KY, MA, MD, MI, MO, NC, NJ, NV, NY, OH, PA, RI, SC, TN, TX, UT, VA, and WA

Client Login